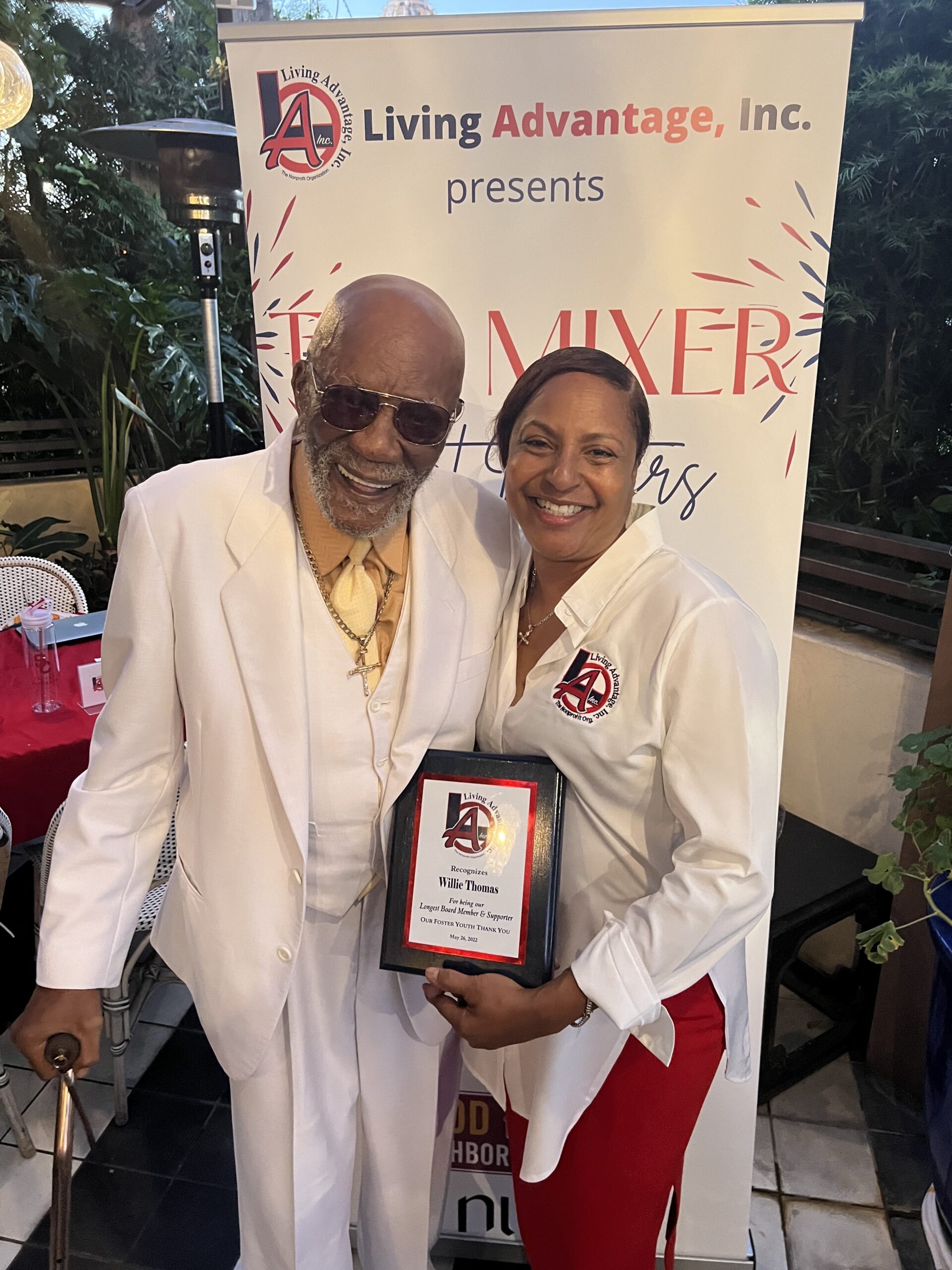

Senator Lola Smallwood-Cuevas (D- Los Angeles) and Assemblymember Tina McKinnor ( D-Inglewood) led the CLBC Demand Diversity press conference on July 13, 2023. Photo by Antonio Harvey (CBM)

Antonio Ray Harvey | California Black Media

Film studios in Hollywood took a one-two punch last week after actors announced they were joining the ongoing writers’ strike and as legislators in Sacramento questioned their commitment to Diversity Equity and Inclusion (DEI).

On July 13, California Legislative Black Caucus (CLBC) members Sen. Lola Smallwood-Cuevas (D-Los Angeles) and Assemblymember Tina McKinnor (D-Inglewood) led a group of lawmakers led a news conference at the State Capitol to express their concerns over various news reports of abrupt departures of Black women leaving high-profile careers in Hollywood after the state recently approved $1.6 billion in tax credits for the industry.

The press conference was held the same day the Screen Actors Guild-American Federation of Television and Radio Artists (SAG-AFTRA), the union representing Hollywood actors, joined striking Writers Guild of America (WGA) members in the biggest labor dispute the American entertainment industry has seen in 63 years.

In recent weeks, several Black women who were executives leading Diversity, Equity, and Inclusion (DEI) initiatives at major entertainment companies have left their positions.

“We are here today, calling on industry executives to meet with the state legislative Black caucus and leaders in the coming weeks to explain what is behind this erasure,” Smallwood-Cuevas (D-Los Angeles) said at the press briefing.

“(We want them to) provide the evidence of how diversity, inclusion and the progress made will continue to move forward given the lack of leadership and gravitas at the forefront of those proposals,” added Smallwood-Cuevas.

Netflix’s vice president, inclusion strategy, Vernā Myers; Disney’s LaTondra Newton, chief diversity officer and senior vice president; Joanna Abeyie, the British Broadcasting Company’s (BBC) creative diversity director; and Warner Bros executive, Terra Potts, executive vice president of worldwide marketing, have all moved on.

In addition, Warner Bros. Discovery’s DEI specialist Karen Horne and Jeanell English, executive VP of impact and inclusion at the Academy of Motion Pictures Arts and Sciences left their DEI roles.

The lawmakers say more Black, Indigenous, People of Color (BIPOC) could join the mass exodus.

Lawmakers at the press conference said the departure of DEI specialists from major Hollywood companies gives the impression that creating an inclusive culture in the American film industry is not a priority for a sector that has a well-documented history of discrimination and exclusion.

“As Vice Chair of the Asian and Pacific Islander Legislative Caucus, we are proud to stand in solidarity with the Black Caucus,” Sen.David Min said. “I don’t want to accuse anybody of anything, but it certainly looks suspicious when in a short timeframe after we pass the $1.6-billion tax credit was signed into law that we see a number of leading African American female Hollywood executives let go.”

Senate Bill (SB) 485, introduced last year by Sen. Anthony Portantino (D- La Cañada Flintridge), provides $1.65 billion in tax credits, or $330 million annually, in financial support for film and television makers and other media content creators. The California Film and Television Production Tax Credit Program was scheduled to sunset on June 30, 2025.

State lawmakers are now asking for meetings and are now looking for ways to hold television and film studios executives accountable for benefitting from state investment that essentially helped create DEI programs.

SB 485 was created after a series of production companies opted to leave California for states that offered larger tax incentive programs. The bill was amended to reflect California’s diverse population.

“I was highly offended to see the industry’s response to a $1.6 billion tax subsidy by quietly eliminating Black women from executive positions with a number of studios,” said McKinnor.

“Many of these women were involved in their studios’ diversity, equity, and inclusion efforts, which raises a serious question about their commitment to diversity, equity and inclusion in the film industry.”

SB 485 states that “This bill, for credit allocations made on or after July 1, 2023, would revise the definition of qualified motion picture for purposes of the credit to require an applicant to provide a diversity workplan that includes goals that are broadly reflective of California’s population.

On July 10, Gov. Gavin Newsom signed SB 132 to extend the state’s $330 million-a-year Film and TV Tax Credit Program an additional five years through fiscal 2030-31.

The Governor’s office put out a statement that SB 132 builds “upon a strong track record of success” and “whose productions have generated more than $23 billion” for the economy.

More than 178,000 cast and crew have been supported by the program. The new budget will create the state’s fourth-generation film/TV tax credit program – known as “Program 4.0.”

“The California Film and Television Tax Credit program has led to the creation of hundreds of thousands of high paying union jobs, it’s supported countless local businesses, and pumped billions of dollars into the state’s economy,” said Charles Rivkin, Chairman and CEO of the Motion Picture Association. “The 4.0 version of the program, signed into law by Governor Newsom, will build on that success by creating new

commitments to diversity, equity, and inclusion and establishing a pilot program on production safety, among other provisions.”

McKinnor said, “While the California film tax credit 4.0 proposal builds upon previous work to solidify California as the entertainment capital of the world, it does not include requirements to increase diversity of its below-the-line hiring.

“The California film tax credit 4.0 only requires a good-faith effort. California, that’s not good enough,” McKinnor continued. “We should all expect more from an industry receiving $1.6 billion in subsidies from California taxpayers.”

Smallwood-Cuevas, McKinnor, and other members of the California legislature want to make amendments to SB 132 that will keep DEI programs intact.

They expect to sit down with members of the film and television industry, union representatives, and Gov. Newsom to get clarity of the entertainment business’ efforts to promote and stabilize DEI initiatives.

“We want progress towards real inclusion and equity in this industry and we want to make sure that our tax dollars are not in any way involved in this erasure,” Smallwood-Cuevas said. “We hope that these conversations will lead to a commitment and level of trust that will allow us to continue to move forward and expand our investment in this important industry.”